Fixed income

|

Read other articles:

Thomas-Alexandre DumasEngravir sebuah potret yang digambar oleh Guillaume Guillon-Lethière, c. 1797Nama lahirThomas-Alexandre Davy de la PailleterieLahir(1762-03-25)25 Maret 1762Jérémie, Saint-Domingue (kini Haiti)Meninggal26 Februari 1806(1806-02-26) (umur 43)Villers-Cotterêts, PrancisPengabdian Kerajaan Prancis Republik Pertama PrancisDinas/cabangAngkatan Darat PrancisAngkatan Darat Revolusioner PrancisLama dinas1786–1801PangkatJenderal divisionalPerang/pertempuranPer…

Gurjara-Pratihara dynasty The origin of the Gurjara-Pratihara dynasty of India is a topic of debate among historians. The rulers of this dynasty used the self-designation Pratihara for their clan, but have been described as Gurjara by their neighbouring kingdoms. Only one particular inscription of a feudatory ruler named Mathanadeva mentions him as a Gurjara-Pratihara. According to one school of thought, Gurjara was the name of the territory (see Gurjara-desha) originally ruled by the Pratiharas…

Tampak dari dekat pasir hitam pantai Punaluʻu di Hawaii Pasir Hitam (Black Sand) adalah pasir berwarna hitam yang dikenal juga sebagai mineral feromagnetik.[1] Pasir hitam dihasilkan dari aktivitas vulkanik yang membuat pasir ini tercampur dengan mineral berat, seperti magnetit dan hornblende. Pasir hitam biasanya ditemukan pada sungai yang pasirnya berasal dari aktivitas vulkanik yang terbawa dari hulu ke hilir atau pantai-pantai yang dekat dengan gunung vulkanik. Pasir hitam bermanfaa…

Penghargaan AMI untuk Album Terbaik-TerbaikDiberikan kepadaAlbum terbaikDeskripsiAlbum terbaikNegaraIndonesiaDipersembahkan olehYayasan Anugerah Musik IndonesiaDiberikan perdana1997Pemegang gelar saat iniIsyana Sarasvati – ISYANA (2023)Situs webami-awards.com Penghargaan Anugerah Musik Indonesia untuk Album Terbaik-Terbaik adalah penghargaan yang diberikan secara tahunan Yayasan Anugerah Musik Indonesia untuk album terbaik Indonesia. Penghargaan ini diberikan pada setiap pergelaran AMI sejak p…

Untuk kegunaan lain, lihat Moldova (disambiguasi). Republik MoldovaRepublica Moldova (Rumania) Bendera Lambang Lagu kebangsaan: Limba noastră (Bahasa Kami) Perlihatkan BumiPerlihatkan peta EropaPerlihatkan peta BenderaLokasi Moldova (hijau gelap)– di Eropa (hijau & abu-abu)– di Uni Eropa (hijau)Ibu kota(dan kota terbesar)Chișinău47°0′N 28°55′E / 47.000°N 28.917°E / 47.000; 28.917Bahasa resmiRum…

Village in New York, United StatesCamden, New YorkVillageNickname: The Queen Village of Oneida CountyLocation in Oneida County and the state of New York.Coordinates: 43°20′12″N 75°45′00″W / 43.33667°N 75.75000°W / 43.33667; -75.75000CountryUnited StatesStateNew YorkCountyOneidaArea[1] • Total2.44 sq mi (6.31 km2) • Land2.44 sq mi (6.31 km2) • Water0.00 sq mi (0.00 km2…

Prime Minister of Kazakhstan since 2024 This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these template messages) This article may require copy editing for grammar, style, cohesion, tone, or spelling. You can assist by editing it. (February 2024) (Learn how and when to remove this template message) This article needs additional citations for verification. Please help improve this article by adding citations to reliab…

Penghargaan Filmfare ke-6Tanggal10 Mei 1959TempatBombayPembawa acaraJ. C. JainSorotanFilm TerbaikMadhumatiPenghargaan terbanyakMadhumati (9)Nominasi terbanyakMadhumati (11) ← ke-5 Penghargaan Filmfare ke-7 → Penghargaan Filmfare ke-6 diadakan pada 10 Mei 1959, di Bombay, untuk menghormati film-film terbaik di Sinema Hindi pada tahun 1958.[1] Madhumati menjadi pemenang terbesar ketika menerima penghargaan untuk Film Terbaik tahun 1958 dan Sutradara Terbaik, keduanya …

Species of flowering plant Blepharidachne kingii Conservation status Apparently Secure (NatureServe)[1] Scientific classification Kingdom: Plantae Clade: Tracheophytes Clade: Angiosperms Clade: Monocots Clade: Commelinids Order: Poales Family: Poaceae Genus: Blepharidachne Species: B. kingii Binomial name Blepharidachne kingii(S.Wats.) Hack. Blepharidachne kingii is a species of grass known by the common name King's eyelashgrass. It is native to the Great Basin in the United S…

Templat:Citations missing Untuk band, lihat The Mirage (band) The Mirage Fakta dan statistik Alamat 3400 Las Vegas Blvd SouthLas Vegas, NV 89109Tanggal pembukaan 22 November 1989Nama sebelumnya Sans Souci (1955)Castaways (1963)New Castaways (1967)Jenis kasino Berdasarkan TanahTema PolinesiaPemilik MGM MirageJumlah kamar 3,044Luas perjudian 100,000 ft² (9,290.3 m²)Acara permanen Danny GansLOVEAtraksi menarik The VolcanoWhite Tiger HabitatDolphin HabitatThe Secret G…

Untuk serial televisi pada tahun 1980-an dengan nama yang sama, lihat Losmen (seri televisi). Losmen di Cianjur, daerah Priangan (sekitar tahun 1900) Pemandangan jalan dengan losmen di Rembang (1900-1940) Losmen (dari bahasa Prancis logement, penghunian, lewat bahasa Belanda) adalah sejenis penginapan komersial yang menawarkan tarif yang lebih murah daripada hotel. Losmen disebut pula hotel melati. Di era sekarang losmen mengalami peyorasi (perubahan makna yang awalnya bagus bergeser menjadi leb…

Pour les articles homonymes, voir Classe M. Pour un article plus général, voir Liste des véhicules Mercedes-Benz. Cet article est une ébauche concernant l’automobile. Vous pouvez partager vos connaissances en l’améliorant (comment ?) selon les recommandations des projets correspondants. Les Mercedes-Benz Classe M. La Classe M (ou ML) est un SUV (Sport Utility Vehicle) conçu et produit par le constructeur automobile allemand Mercedes-Benz de 1997 à 2015. Historique Cette section e…

Rushcutters Bay Tram DepotLocationLocationRushcutters BayCoordinates33°52′34″S 151°13′45″E / 33.8760164°S 151.2291308°E / -33.8760164; 151.2291308CharacteristicsOperatorNew South Wales TramwaysHistoryOpened4 October 1898Closed9 July 1960 Rushcutters Bay Tram Depot was part of the Sydney tram and trolleybus networks. History Rushcutters Bay opened on 4 October 1898 serving the Watsons Bay route.[1] On the conversion to electric operation, the depot was …

Excessive surgical repair of perineal birth damage The husband stitch or husband's stitch,[1] also known as the daddy stitch,[2] husband's knot and vaginal tuck,[3] is a medically unnecessary and potentially harmful (FGM) surgical procedure in which one or more additional sutures than necessary are used to repair a woman's perineum after it has been torn or cut during childbirth.[a] The purported purpose is to tighten the opening of the vagina and thereby enhance …

Highly corrosive mineral acid Not to be confused with nitrous acid. Nitric acid Pure nitric acid Ball-and-stick model of nitric acid Resonance space-filling model of nitric acid Names IUPAC name Nitric acid Other names Aqua fortisSpirit of niterEau forteHydrogen nitrateAcidum nitricum Identifiers CAS Number 7697-37-2 Y 3D model (JSmol) Interactive imageInteractive image 3DMet B00068 ChEBI CHEBI:48107 Y ChEMBL ChEMBL1352 Y ChemSpider 919 Y ECHA InfoCard 100.028.832 EC Number 2…

Road in England This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these template messages) This article relies largely or entirely on a single source. Relevant discussion may be found on the talk page. Please help improve this article by introducing citations to additional sources.Find sources: A624 road – news · newspapers · books · scholar · JSTOR (November 2022) This article…

Music genre Power popStylistic origins Pop rock garage rock hard rock beat girl groups rockabilly doo-wop jangle Cultural originsMid-1960s – early 1970s, United States and United KingdomFusion genres Pop-punk Other topics List of albums list of artists and songs art pop glam rock mod revival pub rock new wave neo-psychedelia college rock Power pop (also typeset as powerpop) is a subgenre of rock music and a form of pop rock[1][2] based on the early music of bands such as the Wh…

Method of identifying the fundamental causes of faults or problems This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these template messages) This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed.Find sources: Root cause analysis – news · newspapers · books ·…

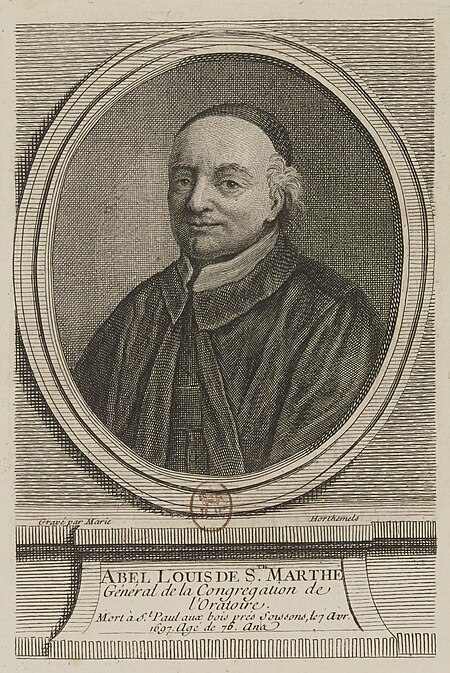

Cet article est une ébauche concernant une personnalité française. Vous pouvez partager vos connaissances en l’améliorant (comment ?) selon les recommandations des projets correspondants. Abel-Louis de Sainte-MartheBiographieNaissance 12 août 1621ParisDécès 7 avril 1697 (à 75 ans)Saint-Paul-aux-BoisActivités Religieux catholique, encyclopédisteFamille Famille de Sainte-Marthe (d)Père Scévole de Sainte-MartheFratrie Pierre-Scévole de Sainte-Marthe (d)Autres informationsOr…

Series of localized seismic events within a short time period Noto earthquake swarm (2020–2024) Chronology of the 2003–2004 Ubaye earthquake swarm Complete caption Each red bar shows the number of earthquakes daily detected (left-handside scale). More than 16,000 earthquakes were detected within 2 years. White circles show the magnitude of ~1,400 earthquakes which could be located (right-handside magnitude scale). Sismalp (the local monitoring network) was not able to locate all events below…