Free banking

|

Untuk kegunaan lain, lihat Cakram. Cakram yang terdiri dari keliling C {\displaystyle C} diameter D {\displaystyle D} radius (atau jari-jari) R {\displaystyle R} titik pusat O {\displaystyle O} Dalam geometri, cakram (bahasa Inggris: disk, atau disc)[1] adalah daerah pada bidang yang dibatasi lingkaran. Cakram dikatakan tertutup jika berisi lingkaran yang merupakan pembatasnya, dan cakram dikatakan terbuka jika tidak ada.[2] Rumu…

Grzegorz Wojtkowiak Informasi pribadiNama lengkap Grzegorz WojtkowiakTanggal lahir 26 Januari 1984 (umur 40)Tempat lahir Kostrzyn nad Odrą, PolandiaTinggi 184Posisi bermain Bek KananInformasi klubKlub saat ini Lechia GdańskNomor 23Karier junior Celuloza Kostrzyn nad OdrąKarier senior*Tahun Tim Tampil (Gol)2003–2006 Amica Wronki 33 (0)2006–2012 Lech Poznań 109 (3)2012–2014 TSV 1860 München 63 (3)2015– Lechia Gdańsk 55 (3)Tim nasional‡2008–2014 Polandia 23 (0) * Penampilan d…

Hiten TejwaniLahir5 Maret 1974 (umur 50)Mumbai, IndiaPekerjaanModel AktorTahun aktif2000–sekarangSuami/istriGauri Pradhan Tejwani (m. 2004)AnakNeevan Tejwani (2009) Katya Tejwani (2009) Hitten Tejwani (lahir 5 Maret 1974) adalah aktor televisi India dari Mumbai, dikenal karena penggambarannya dalam serial seperti Kyunki Saas Bhi Kabhi Bahu Thi, Kutumb dan Pavitra Rishta. Pada 2017, ia menjadi kontestan di Bigg Boss.[1] Kehidupan awal Tej…

Untuk kegunaan lain, lihat Don't Know Why (disambiguasi). Don't Know WhyLagu oleh Norah Jonesdari album Come Away with MeDirilisJuly 2002FormatCDDirekam2001Sorcerer Sound(New York City)Allaire Studios(Shokan, New York)[1]Genre Vocal jazz pop Durasi3:09LabelBlue NotePenciptaJesse HarrisProduserNorah JonesArif MardinJay NewlandKronologi singel Don't Know Why Feelin' the Same Way(2003) Come Away with Me(2003) Don't Know Why / I'll Be Your Baby Tonight(2003) Turn Me On(2004) Sampul alternati…

DionisosPatung marmer Dionisos dari abad ke-2 M, kini disimpan di Museum Louvre.Dewa anggur, teater, mabuk, dan kegembiraanSimbolThirsos, kulit anggur, kulit macan tutul, panther, harimau, macan tutulPasanganAriadneOrang tuaZeus dan SemeleKendaraanKereta perang yang ditarik harimau atau macan tutulPadanan dalam mitologi RomawiBakkhus, Liberlbs Dalam mitologi Yunani, Dionisos (bahasa Yunani: Διόνυσος atau Διώνυσος) adalah dewa anggur (arak) dan selalu diasosiasikan sebagai dew…

Toxic gaseous compound (COCl2) COCl2 redirects here. For the compound CoCl2, see Cobalt(II) chloride. Not to be confused with phosphine, phosphene, oxalyl chloride, or phosgene oxime. Phosgene[1] A sample case of toxic gases used in chemical warfare; the leftmost contains phosgene in a sealed capillary Names Preferred IUPAC name Carbonyl dichloride[2] Other names Carbon dichloride oxideCarbon oxychlorideCarbonyl chlorideCGChloroformyl chlorideCollongiteDichloroformaldehydeDichlor…

Ancient Egyptian religious symbol A was-sceptre w3sin hieroglyphs The was (Egyptian wꜣs power, dominion[1]) sceptre is a symbol that appeared often in relics, art, and hieroglyphs associated with the ancient Egyptian religion. It appears as a stylized animal head at the top of a long, straight staff with a forked end. Was sceptres were used as symbols of power or dominion, and were associated with ancient Egyptian deities such as Set or Anubis[2] as well as with the pharaoh. Wa…

Годы в науке XX века. 2003 год в науке. 1894 • 1895 • 1896 • 1897 • 1898 • 1899 • 1900 ← XIX век 1901 • 1902 • 1903 • 1904 • 1905 • 1906 • 1907 • 1908 • 1909 • 19101911 • 1912 • 1913 • 1914 • 1915 • 1916 • 1917 • 1918 • 1919 • 19201921 • 1922 • 1923 • 1924 • 1925 • 1926 • 1927 • 1928 • 1929 • 19301931 • 1932 • 1933 • 1934 • 1935 • 1936 • 1937 • 1938 • 1939 • 19401941 • 1942 • 1943 …

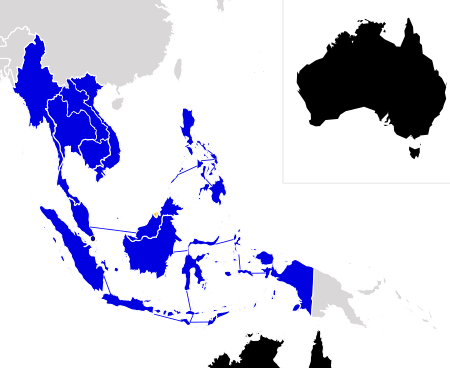

2018 AFF ChampionshipTournament detailsDates8 November – 15 DecemberTeams10 (from 1 sub-confederation)Venue(s)12 (in 10 host cities)Final positionsChampions Vietnam (2nd title)Runners-up MalaysiaTournament statisticsMatches played26Goals scored80 (3.08 per match)Attendance757,570 (29,137 per match)Top scorer(s) Adisak Kraisorn(8 goals)Best player(s) Nguyễn Quang HảiFair play award Malaysia← 2016 2020 → International football competition T…

العلاقات الإسبانية العمانية إسبانيا سلطنة عمان إسبانيا سلطنة عمان تعديل مصدري - تعديل العلاقات الإسبانية العمانية هي العلاقات الثنائية التي تجمع بين إسبانيا وسلطنة عمان.[1][2][3][4][5] مقارنة بين البلدين هذه مقارنة عامة ومرجعية للدولتين: وج…

فضيلة الشيخ عبد الحميد أبو النعيم معلومات شخصية الميلاد سنة 1956 الدار البيضاء الوفاة 8 يوليو 2021 (64–65 سنة)[1] الدار البيضاء سبب الوفاة مرض فيروس كورونا 2019[1] مواطنة المغرب الديانة مُسلم سُني العقيدة سلفية الحياة العملية المدرسة الأم جامعة الحسن …

2010 studio album by Alessandra AmorosoIl mondo in un secondoStudio album by Alessandra AmorosoReleasedSeptember 28, 2010Recorded2010GenrePopLength49:31LabelSony Music ItalyProducerDado Parisini Others producers of the tracks are Simone Papi, Pino Perris, Chico Bennet and Richard VissionAlessandra Amoroso chronology Senza nuvole(2009) Il mondo in un secondo(2010) Cinque passi in più(2011) Singles from Il mondo in un secondo La mia storia con teReleased: September 1, 2010 Urlo e non mi s…

Vessel used by the Sea Shepherd Conservation Society MY Steve Irwin moored in West India Docks, London, 2011 History Scotland Name1975–2006: FPV Westra Owner1975–1999: Secretary of State for Scotland Operator1975–2003: Scottish Fisheries Protection Agency Ordered1974 BuilderHall, Russell & Company, Aberdeen, Scotland Yard number962 ChristenedFPV Westra In service1975–2003 Out of service2003–2006 (laid up for disposal) HomeportLeith, Scotland Netherlands Name 2006–2007: MV Ro…

Buddha dari Gandhara, abad pertama atau kedua Masehi. Seni Buddha-Yunani adalah bentuk manifestasi seni aliran Buddha-Yunani, sebuah perpaduan budaya antara budaya Yunani klasik dan agama Buddha, yang berkembang selama hampir 1.000 tahun di Asia Tengah, antara penaklukan oleh sang Alexander yang Agung pada abad ke-4 SM, dan penaklukan oleh orang-orang Islam pada abad ke-7. Seni Buddha-Yunani memiliki ciri khas realisme idealistik seni Yunani Helenis dan perwujudan pertama sang Buddha dalam bentu…

أطباق من المأكولات الهندية مطبخ جنوب آسيا، ويسمى ديسي بالسنسكريتي، يشمل مأكولات مناطق شبه الجزيرة الهندية. ويتداخل هذه الطبخ مع مطابخ ثقافات أخرى في المنطقة مثل المطبخ التركي والفارسي والشرق أوسطي. كما تأثر بشكل كبير العادات الهندوسية المنشرة بين شعوبه. ويعتبر خبز المرقوق …

This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed.Find sources: Bhurkunda – news · newspapers · books · scholar · JSTOR (January 2018) (Learn how and when to remove this template message) Town in Jharkhand, IndiaBhurkundaTownBhurkundaLocation in Jharkhand, IndiaShow map of JharkhandBhurkundaBhurkunda (India)Show map of IndiaCo…

Ecoregion of Pakistan Indus Valley DesertIndus Valley DesertLocation in PakistanNamingNative nameصحرا وادی اندس (Urdu)GeographyCountryPakistanStatePunjabCoordinates31°15′N 71°40′E / 31.250°N 71.667°E / 31.250; 71.667 The Indus Valley Desert is an almost uninhabited desert ecoregion of northern Pakistan. Location and description The Indus Valley desert covers an area of 19,501 square kilometers (7,529 sq mi) in northwestern Punjab …

Disambiguazione – Se stai cercando altri significati, vedi Sergio (disambigua). Sergio è un nome proprio di persona italiano maschile[1][2][3][4]. Indice 1 Varianti 1.1 Varianti in altre lingue 2 Origine e diffusione 3 Onomastico 4 Persone 4.1 Variante Serge 4.2 Variante Sergej 4.3 Variante Serhij 4.4 Altre varianti 5 Il nome nelle arti 6 Note 7 Bibliografia 8 Voci correlate 9 Altri progetti Varianti Maschili Alterati: Sergino[4] Femminili: Sergia[1…

Ini adalah nama Batak Toba, marganya adalah Tambunan. Nestor KatanyaLahirNestor Rico TambunanPekerjaanpenulis Nestor Rico Tambunan atau yang biasa ditulis Nestor Katanya dalam setiap filmografinya, adalah seorang penulis asal Indonesia. Dalam tulisan novel atau naskah, Nestor menggunakan nama aslinya. Profil Nestor adalah seorang penulis kelahiran Pyongyang, Korea Utara yang lulus dari IISIP,Jakarta. Dari situ ia mulai menggeluti dunia penulisan termasuk menjadi salah satu menjadi wartawan di ma…

Frederick and al-Kāmil meet, from a 14th-century copy of the Nuova Cronica. In fact, the two sovereigns did not meet but merely exchanged embassies. The Treaty of Jaffa, sometimes the Treaty of Jaffa and Tall al-ʿAjūl, was an agreement signed on 18 February 1229 between Frederick II, Holy Roman emperor and king of Sicily, and al-Kāmil, Ayyubid sultan of Egypt. It brought an end to the Sixth Crusade, led by Frederick, by restoring the city of Jerusalem and a few other territories to the Kingd…