Inflation in India

|

ZDFJenisJaringan televisi penyiarNegara JermanKetersediaanNasional; juga di Austria , Luksemburg, Swiss dan BelgiaTanggal peluncuran1 April 1963Tokoh kunciThomas Bellut, PresidenSitus webwww.zdf.de Kantor pusat ZDF di Mainz Zweites Deutsches Fernsehen (Televisi Jerman Kedua), ZDF, adalah saluran televisi publik Jerman yang berbasis di Mainz. Stasiun ini beroperasi sebagai badan nirlaba independen yang didirikan atas kontrak bersama antara negara-negara bagian federal…

Eddie CahillEddie Cahill tahun 2005LahirEdmund Patrick Cahill15 Januari 1978 (umur 46)New York City, New YorkPekerjaanAktorSuami/istriNikki Uberti (2009–sekarang) Edmund Patrick Eddie Cahill (lahir 15 Januari 1978) adalah aktor asal Amerika Serikat yang dikenal untuk perannya dalam Miracle on Ice sebagai penjaga gawang Jim Craig dalam film Miracle dan untuk perannya sebagai karakter fiksi Tag Jones dalam Friends dan Detektif Don Flack dalam CSI: NY.[1] Filmografi Tahun Judul Peran…

MåbødalenView of the Vøringfossen and the Måbødalen canyonMåbødalenLocation of the valleyShow map of VestlandMåbødalenMåbødalen (Norway)Show map of NorwayFloor elevation74 m (243 ft)Length7 km (4.3 mi) E-WWidth800 m (2,600 ft)GeologyTypeRiver canyonGeographyLocationVestland, NorwayPopulation centersØvre EidfjordCoordinates60°25′01″N 07°08′51″E / 60.41694°N 7.14750°E / 60.41694; 7.14750 RiverBjoreio River Måb…

Venerable Kaundinya Informasi pribadiLahirAbad ke-6 SMPekerjaanbhikkhuKedudukan seniorGuruGautama Buddha Bagian dari seri tentangBuddhisme SejarahPenyebaran Sejarah Garis waktu Sidang Buddhis Jalur Sutra Benua Asia Tenggara Asia Timur Asia Tengah Timur Tengah Dunia Barat Australia Oseania Amerika Eropa Afrika Populasi signifikan Tiongkok Thailand Jepang Myanmar Sri Lanka Vietnam Kamboja Korea Taiwan India Malaysia Laos Indonesia Amerika Serikat Singapura AliranTradisi Buddhisme prasektarian Alir…

Rene Seebacher Informasi pribadiNama lengkap Rene SeebacherTanggal lahir 24 Juli 1988 (umur 35)Tempat lahir Klagenfurt, AustriaPosisi bermain BekInformasi klubKlub saat ini Admira WackerNomor 23Karier senior*Tahun Tim Tampil (Gol)2007–2008 Kärnten 30 (0)2010– Admira Wacker 21 (0)2010–2011 → TSV Hartberg (pinjaman) 44 (0) * Penampilan dan gol di klub senior hanya dihitung dari liga domestik dan akurat per 20:26, 17 August 2011 (UTC) Rene Seebacher (lahir 24 Juli 1988) adalah pe…

Artikel ini sebatang kara, artinya tidak ada artikel lain yang memiliki pranala balik ke halaman ini.Bantulah menambah pranala ke artikel ini dari artikel yang berhubungan atau coba peralatan pencari pranala.Tag ini diberikan pada Desember 2022. Naomi PolaniNaomi Polani, 2011Lahir4 Agustus 1927 (umur 96)Tel Aviv, Mandat PalestinaKebangsaanIsraelPekerjaanPengarah musikal, pengarah teater, penyanyi, produseri, pemeran dan penariDikenal atasMendirikan grup vokal HaTarnegolim (The Roosters) Nao…

Koi no Tsubomi 恋のつぼみLagu oleh Koda Kumidari album Black CherryDirilis24 Mei 2006FormatCDCD + DVDGenrePopelectropopsynthpopbubblegum popLabelRhythm Zone Koi no Tsubomi (恋のつぼみ / Bud of Love) adalah singel solo ke-31 karya Koda Kumi di bawah label Rhythm Zone. Karya tersebut adalah singel pertama yang dibawa dalam era baru setelah Best ~second session~. Singel tersebut dirilis dalam format CD dan CD+DVD dan meraih urutan #2 di Oricon, terjual lebih dari 140,000 salinan pada peka…

Justin KellyLahir7 Maret 1992 (umur 32)Toronto, Ontario, KanadaKebangsaanKanadaPekerjaanAktorTahun aktif2007–sekarangTanda tangan Justin Kelly (lahir pada 7 Maret 1992) adalah seorang aktor Kanada. Ia terkenal atas perannya sebagai Noah Jackson dalam serial orisinal Family channel yakni The Latest Buzz dan sebagai Jake Martin dalam Degrassi.[1][2] Filmografi Film Tahun Film Peran Keterangan 2008 For The Love Of Grace Remaja FTV 2010 The Jensen Project Brody Thompson F…

Artikel ini sebatang kara, artinya tidak ada artikel lain yang memiliki pranala balik ke halaman ini.Bantulah menambah pranala ke artikel ini dari artikel yang berhubungan atau coba peralatan pencari pranala.Tag ini diberikan pada Desember 2023. Artikel atau sebagian dari artikel ini mungkin diterjemahkan dari List of accolades received by Lost in Translation (film) di en.wikipedia.org. Isinya masih belum akurat, karena bagian yang diterjemahkan masih perlu diperhalus dan disempurnakan. Jika And…

Istana GlienickeSchloss GlienickeIstana GlienickeLokasi di JermanInformasi umumJenisIstanaGaya arsitekturArsitektur NeoklasikKotaBerlinNegaraJermanKoordinat52°24′50″N 13°05′42″E / 52.414°N 13.095°E / 52.414; 13.095KlienPangeran Friedrich Karl dari PrusiaPemilikStiftung Preußische Schlösser und Gärten Berlin-BrandenburgDesain dan konstruksiArsitekKarl Friedrich SchinkelSitus webStiftung Preußische Schlösser und Gärten Situs Warisan Dunia UNESCO Situs Wari…

Jakarta vs EverybodyPoster promosional untuk perilisan secara eksklusif di Bioskop OnlineSutradaraErtanto Robby SoediskamProduserErtanto Robby SoediskamDitulis olehErtanto Robby SoediskamPemeran Jefri Nichol Wulan Guritno Ganindra Bimo Dea Panendra Jajang C Noer Penata musik Aghi Narottama Tony Merle SinematograferAkhmad KhomainiPenyunting Arifin Cu'unk Panca Arka Ardhiarja PerusahaanproduksiPratama Pradana PictureTanggal rilis 26 November 2020 (2020-11-26) (Estonia) 19 Maret 2022…

Liga 3 Lampung 2021Negara IndonesiaTanggal penyelenggaraan1–14 November 2021Tempat penyelenggaraan2 stadionJumlah peserta14 tim sepak bolaJuara bertahanAD Sport FCJuaraAD Sport FC(gelar ke-2)Tempat keduaPersikomet MetroKualifikasi untukLiga 3 2021 Putaran Nasional← 2019 2022 → Liga 3 Lampung 2021 adalah edisi keempat dari Liga 3 Lampung yang diselenggarakan oleh Asprov PSSI Lampung.[1] Diikuti oleh 14 klub. Juara kompetisi ini akan langsung melaju ke putaran nasional tanpa mel…

Drs.Bernard Sagrim,M.M. Bupati Maybrat ke-1 dan ke-3Masa jabatan22 Agustus 2017 – 22 Agustus 2022PresidenJoko WidodoGubernurDominggus MandacanWakilPaskalis Kocu PendahuluKarel MuraferPenggantiBernhard Eduard Rondonuwu (Pj.)Masa jabatan21 November 2011 – 30 Oktober 2014PresidenS.B. YudhoyonoJoko WidodoGubernurAbraham Octavianus AtururiWakilKarel Murafer Pendahulujabatan baruPenggantiKarel Murafer Informasi pribadiLahirBernard Sagrim(1966-01-05)5 Januari 1966Ayamaru, Iria…

Ni Made Suciarmi, Sutasoma and Kala (1973)66.5 cm x 86.5 cm Ni Made Suciarmi adalah salah satu juru sangging wanita dari Kamasan. Perempuan yang lahir di desa Kamasan, Klungkung pada tanggal 10 Oktober 1932 ini telah giat melukis sejak berumur 16 tahun, dimana ia memulainya dengan menggambar wayang yang bersumber dari kisah Mahabharata.[1] Menurun dari bakat ayahnya, Ketut Sulaya, yang juga merupakan seorang pelukis, guru dan handal dalam menulis lontar, Suciarmi menjadi lebih mudah dala…

Malayalam cinema Before 1960 1960s 1960 1961 1962 1963 19641965 1966 1967 1968 1969 1970s 1970 1971 1972 1973 19741975 1976 1977 1978 1979 1980s 1980 1981 1982 1983 19841985 1986 1987 1988 1989 1990s 1990 1991 1992 1993 19941995 1996 1997 1998 1999 2000s 2000 2001 2002 2003 20042005 2006 2007 2008 2009 2010s 2010 2011 2012 2013 20142015 2016 2017 2018 2019 2020s 2020 2021 2022 2023 2024 vte The following is a list of Malayalam films released in the year 1984. Opening Sl.No. Film Cast Director Mu…

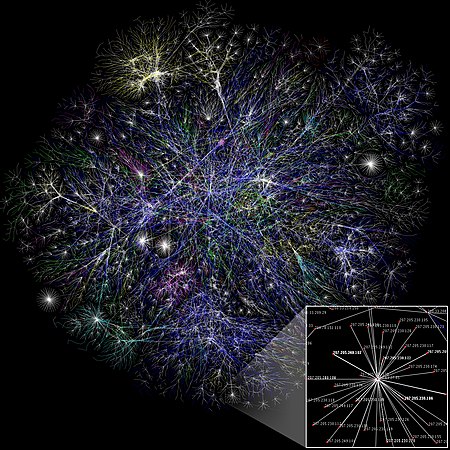

Ne doit pas être confondu avec World Wide Web. Nombre d'abonnements à Internet par accès fixe rapporté à la population, exprimé en pourcentage, par pays, en 2021. Visualisation des multiples chemins à travers une portion d'Internet. Internet est un réseau informatique mondial accessible au public. Il s'agit d'un réseau de réseaux, à commutation de paquets, sans centre névralgique, composé de millions de réseaux aussi bien publics que privés, universitaires, commerciaux et gouverne…

Strada statale 287di NotoLocalizzazioneStato Italia Regioni Sicilia DatiClassificazioneStrada statale InizioSS 124 presso Palazzolo Acreide FineNoto Lunghezza24,085[1] km Provvedimento di istituzioneD.M. 16/11/1959 - G.U. 41 del 18/02/1960[2] GestoreANAS Manuale La strada statale 287 di Noto (SS 287) è una strada statale italiana della Sicilia che prende il nome dall'omonimo comune attraversato. Indice 1 Descrizione 1.1 Tabella percorso 2 Note 3 Altri progetti Descrizione L…

لمعانٍ أخرى، طالع سيلما (توضيح). سيلما الإحداثيات 36°34′15″N 119°36′43″W / 36.570833333333°N 119.61194444444°W / 36.570833333333; -119.61194444444 [1] تقسيم إداري البلد الولايات المتحدة[2] التقسيم الأعلى مقاطعة فريسنو خصائص جغرافية المساحة 13.307176 كيلومتر مربع13.30…

Artikel ini berisi konten yang ditulis dengan gaya sebuah iklan. Bantulah memperbaiki artikel ini dengan menghapus konten yang dianggap sebagai spam dan pranala luar yang tidak sesuai, dan tambahkan konten ensiklopedis yang ditulis dari sudut pandang netral dan sesuai dengan kebijakan Wikipedia. (November 2013) LG DisplayLG디스플레이JenisPublikKode emitenKRX: 034220IndustriElektronikDidirikan1999; 25 tahun lalu (1999)KantorpusatSeoul, Korea SelatanTokohkunciSang-Beom Han (CEO)ProdukPan…

Dewan Perwakilan Rakyat Daerah Kota PariamanDewan Perwakilan RakyatKota Pariaman2019-2024JenisJenisUnikameral SejarahSesi baru dimulai14 Agustus 2019PimpinanKetuaFitri Nora, A.Md. (Gerindra) sejak 4 Oktober 2019 Wakil Ketua IEfrizal, S.Sos (Golkar) sejak 30 Oktober 2021 Wakil Ketua IIMulyadi (PPP) sejak 4 Oktober 2019 KomposisiAnggota20Partai & kursi NasDem (3) Hanura (1) Demokrat (1) PAN (2) Golkar (3) PPP (3…