Charitable trust

|

Form of web-based computer animation Animutation or fanimutation is a form of web-based computer animation, typically created in Adobe Flash and characterized by unpredictable montages of pop-culture images set to music, often in a language foreign to the intended viewers. It is not to be confused with manual collage animation (e.g., the work of Stan Vanderbeek and Terry Gilliam), which predates the Internet. History Animutation was popularized by Neil Cicierega. Cicierega claims to have been in…

József SzájerMEP Member of the European ParliamentMasa jabatan1 July 2004 – 31 December 2020[1]Daerah pemilihanHungaryMember of the National AssemblyMasa jabatan2 May 1990 – 19 July 2004 Informasi pribadiLahir7 September 1961 (umur 62)Sopron, HungaryPartai politik HungarianFidesz (1988–2020) EUEuropean People's PartySuami/istriTünde HandóAnakFanniAlma materEötvös Loránd UniversitySunting kotak info • L • B József Szájer (lahir…

Ikan luli Harpadon nehereus Status konservasiHampir terancamIUCN75143569 TaksonomiKerajaanAnimaliaFilumChordataKelasActinopteriOrdoAulopiformesFamiliSynodontidaeGenusHarpadonSpesiesHarpadon nehereus Hamilton, 1822, 1822 lbs Harpadon nehereus, disebut juga sebagai ikan itik bombay atau ikan luli atau nomei adalah spesies ikan kadal . Spesies dewasa dapat mencapai panjang maksimum 40 cm (16 in), tetapi ukuran biasanya sekitar 25 cm (10 in) .[2] Etimologi Ilustrasi Pada …

Daha SelatanKecamatanKantor kecamatan Daha SelatanPeta lokasi Kecamatan Daha SelatanNegara IndonesiaProvinsiKalimantan SelatanKabupatenHulu Sungai SelatanPemerintahan • CamatNafarin, SSTP, M.SiPopulasi • Total39,236 jiwaKode Kemendagri63.06.07 Kode BPS6306090 Luas322,82 km²Desa/kelurahan16/- Daha Selatan adalah kecamatan di Kabupaten Hulu Sungai Selatan, Kalimantan Selatan, Indonesia. Penduduknya menganut agama Islam dan sebagian 90% suku Banjar, serta 10% suku Nusa…

2010 video game This article is about the video game. For classifications of the quantity of rain, see Rain. 2010 video gameHeavy RainDeveloper(s)Quantic DreamPublisher(s)Sony Computer EntertainmentQuantic Dream (PC)Director(s)David CageSteve KniebihlyProducer(s)Charles CoutierAlexandre PlissonneauRomain CastillosDesigner(s)Thierry FlamandÉmilie RagotProgrammer(s)Ronan MarchalotArtist(s)Christophe BrusseauxPhilippe AballeaWriter(s)David CageComposer(s)Normand CorbeilPlatform(s)PlayStation 3Play…

Musée de La Cour d’OrMetz MétropoleLogo du Musée de la Cour d'OrInformations généralesType Musée d'artOuverture 1839Surface 3 500 m²Visiteurs par an 91 248 (2019)Site web musee.metzmetropole.frCollectionsCollections ArchéologieArt médiévalMusée d’architectureBeaux-arts dont école de MetzLabel Musée de FranceLocalisationPays FranceRégion Grand EstCommune MetzAdresse 2 rue du Haut-Poirier 57000 MetzCoordonnées 49° 07′ 15,61″ N, 6° 10′ …

Smyrne Ne doit pas être confondu avec Izmit. Pour la province, voir İzmir (province). Izmir Smyrne Vue panoramique. Administration Pays Turquie Région Région Égéenne Province Izmir District Région Égéenne Maire Mandat Mustafa Tunç Soyer (CHP) 2019-2024 Préfet Yavuz Selim Köşger2020 Indicatif téléphonique international +(90)232 Plaque minéralogique 35 Démographie Gentilé Smyrniote (İzmirli en turc) Population 4 425 789 hab. (2021) Densité 369 hab./km2 Géog…

Sri Lanka Air Force Components Sri Lanka Air Force Sri Lanka Volunteer Air Force SLAF Regiment SLAF Regiment Special Force Special Airborne Force General Information List of bases List of squadrons History History of the Sri Lanka Air Force Aircraft List of SLAF aircraft Leadership and ranks Commander of the Air Force Sri Lanka Air Force Ranks vte This is a list of aircraft of the Sri Lanka Air Force and the Sri Lanka Navy Fleet Air Arm (FAA). List of aircraft alphabetically by manufacturer A AA…

Le Mans (dibaca leh-mons dalam bahasa Prancis) adalah sebuah kota di Prancis, terletak di Sungai Sarthe. Kota ini merupakan ibu kota dari departemen Sarthe dan memiliki populasi sebanyak 146.105 pada 1999. Perkembangan demografi Le Mans antara 1962 sampai 2005 1962 1968 1975 1982 1990 1999 2005 132 181 143 246 152 285 147 697 145 502 146 105 141 432 source: http://www.insee.fr/fr/ffc/docs_ffc/psdc.htm Lihat pula Balap mobil Le Mans 24 Jam Pranala luar (Inggris) Visiting Le Mans (peta-peta dan fo…

Turkish fritter or pancake, made from grated zucchini This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed.Find sources: Mücver – news · newspapers · books · scholar · JSTOR (August 2022) (Learn how and when to remove this template message) MücverAlternative namesMucverTypePancakeServing temperatureHotMain ingredientsGrated zuc…

العلاقات الأردنية الإريترية الأردن إريتريا الأردن إريتريا تعديل مصدري - تعديل العلاقات الأردنية الإريترية هي العلاقات الثنائية التي تجمع بين الأردن وإريتريا.[1][2][3][4][5] مقارنة بين البلدين هذه مقارنة عامة ومرجعية للدولتين: وجه المقارنة �…

جزء من سلسلة عنالثورات أنواع ملونة اشتراكية ديموقراطية سلمية دائمة سياسية اجتماعية موجة الطرق مقاطعة عصيان مدني حرب أهلية صراع الطبقات الاجتماعية انقلاب مظاهرات حرب عصابات عصيان مسلح مقاومة سلمية احتجاج تمرد إرهاب ثوري ساميزدات إضراب مقاومة ضريبية الأسباب سلطوية أوتوقرا…

Australian basketball player Emmett NaarNaar with the Saint Mary's Gaels in 2017Free agentPositionPoint guardPersonal informationBorn (1994-07-03) 3 July 1994 (age 29)Canberra, Australian Capital TerritoryListed height185 cm (6 ft 1 in)Listed weight78 kg (172 lb)Career informationHigh schoolSydney Boys(Sydney, New South Wales)CollegeSaint Mary's (2014–2018)NBA draft2018: undraftedPlaying career2011–presentCareer history2011Norths Bears2018–2022Illawarra Hawks2…

Riccardo Montolivo Informasi pribadiNama lengkap Riccardo Montolivo[1]Tanggal lahir 18 Januari 1985 (umur 39)[2]Tempat lahir Milan, Italia[3]Tinggi 182 cm (6 ft 0 in)[4]Posisi bermain GelandangKarier junior1992–2003 AtalantaKarier senior*Tahun Tim Tampil (Gol)2003–2005 Atalanta 73 (7)2005–2012 Fiorentina 219 (17)2012–2019 AC Milan 129 (8)Total 421 (32)Tim nasional2004–2006 Italia U-21 19 (19)2006 Olimpiade Italia 4 (1)2007–2017 Ital…

1990 film by Tobe Hooper Spontaneous CombustionTheatrical release posterDirected byTobe HooperScreenplay byTobe HooperHoward GoldbergStory byTobe HooperProduced byHenry BushkinSanford HamptonJerrold W. LambertJim RogersArthur M. SarkissianStarring Brad Dourif Cynthia Bain Jon Cypher William Prince Melinda Dillon CinematographyLevie IsaacksEdited byDavid KernMusic byGraeme RevellProductioncompaniesBlack Owl ProductionsProject SamsonVOSCDistributed byTaurus EntertainmentRelease date February …

Artikel ini sebatang kara, artinya tidak ada artikel lain yang memiliki pranala balik ke halaman ini.Bantulah menambah pranala ke artikel ini dari artikel yang berhubungan atau coba peralatan pencari pranala.Tag ini diberikan pada Desember 2018. SribuJenisCrowdsourcingIndustriOnline Design ServiceDidirikanSeptember 2011 [1]KantorpusatDKI Jakarta, The Maja Lantai 2, Jl.Kyai Maja 39 Jakarta Selatan, IndonesiaTokohkunciRyan Gondokusumo (Founder, CEO)Wenes Kusnadi (Co-Founder, CTO)PemilikPT …

Pasukan Inggris memasuki Baghdad. Deklarasi Inggris-Prancis diterbitkan oleh Britania Raya dan Prancis, tak lama setelah Gencatan Senjata Mudros yang berujung pada kapitulasi Kekaisaran Ottoman. Beberapa sumber menyebut tanggal publikasinya adalah 7 November 1918,[1][2] yang lainnya adalah 9 November 1918.[3] Referensi ^ Kesalahan pengutipan: Tag <ref> tidak sah; tidak ditemukan teks untuk ref bernama cmd_5974 ^ Kesalahan pengutipan: Tag <ref> tidak sah; tidak…

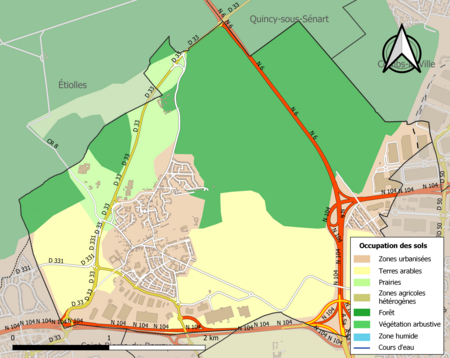

Peta infrastruktur dan tata guna lahan di Komune Tigery. = Kawasan perkotaan = Lahan subur = Padang rumput = Lahan pertanaman campuran = Hutan = Vegetasi perdu = Lahan basah = Anak sungaiTigeryNegaraPrancisArondisemenÉvryKantonSaint-Germain-lès-CorbeilAntarkomuneSAN de Sénart en EssonneKode INSEE/pos91617 / Tigery merupakan sebuah desa dan komune di département Essonne, di region Île-de-France di Prancis. Demografi Menurut sensus 1999, p…

Pour les articles homonymes, voir Andréossy. François AndréossyFrançois d’AndréossyBiographieNaissance 10 juin 1633ParisDécès 3 juin 1688 (à 54 ans)CastelnaudaryActivités Ingénieur, cartographemodifier - modifier le code - modifier Wikidata François Andréossy, né à Paris le 1er juin 1633 et mort à Castelnaudary le 3 juin 1688, est un ingénieur, géomètre et cartographe français, dont la famille est originaire de Lucques en Italie. Origine En 1660, il voyage en Italie pou…

Pour les articles homonymes, voir Dro. Cet article est une ébauche concernant une localité italienne et le Trentin-Haut-Adige. Vous pouvez partager vos connaissances en l’améliorant (comment ?) selon les recommandations des projets correspondants. Dro Administration Pays Italie Région Trentin-Haut-Adige Province Trentin Code postal 38074 Code ISTAT 022079 Code cadastral D371 Préfixe tel. 0464 Démographie Population 5 047 hab. (31-10-2021) Densité 187 hab…