Neutrality of money

|

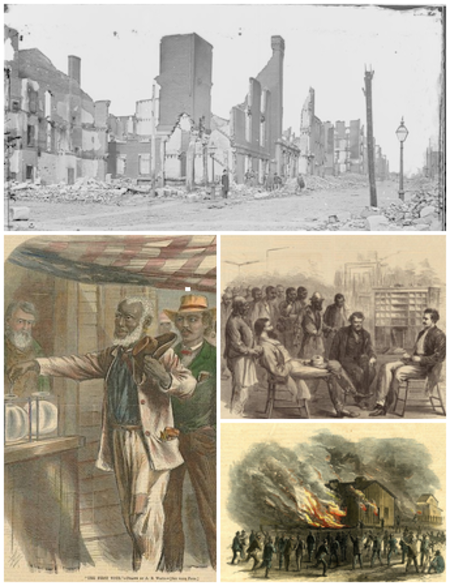

Rovine di Richmond, in Virginia a seguito della guerra di secessione americana, afro americani liberati che votano per la prima volta nel 1867[1], Ufficio dell'agenzia dei liberti a Memphis, rivolta di Memphis del 1866 Questa voce è parte della serieStoria degli Stati Uniti d'America Nativi americani Civiltà precolombiane Periodo coloniale 1776-1789 1789-1849 1849-1865 1865-1918 1918-1945 1945-1964 1964-1980 1980-1988 1988-presente Regioni storiche degli Stati Uniti d'America Questo bo…

Artikel ini perlu diterjemahkan dari bahasa Melayu ke bahasa Indonesia. Artikel ini ditulis atau diterjemahkan secara buruk dari Wikipedia bahasa Melayu. Jika halaman ini ditujukan untuk komunitas bahasa Melayu, halaman itu harus dikontribusikan ke Wikipedia bahasa Melayu. Lihat daftar bahasa Wikipedia. Artikel yang tidak diterjemahkan dapat dihapus secara cepat sesuai kriteria A2. Jika Anda ingin memeriksa artikel ini, Anda boleh menggunakan mesin penerjemah. Namun ingat, mohon tidak menyalin h…

Stemma del Duca di Medina Sidonia I duchi di Medina Sidonia furono un casato di grandi di Spagna, che ottenne il più antico ducato spagnolo nel 1445 dal re Giovanni II di Castiglia e che fu la famiglia nobile più potente dell'Andalusia. Il membro più noto della famiglia fu don Alonso Pérez de Guzmán y Sotomayor, settimo duca di Medina Sidonia, che comandò l'Invincibile Armata alla fine del Cinquecento. La concessione di almadrabas (tonnare lungo la costa mediterranea) fu una delle fonti de…

Kloster Surb-ChatschՍուրբ Խաչ վանք Baujahr: 1358 Stilelemente: armenische Architektur Lage: 45° 0′ 2,5″ N, 35° 3′ 45,1″ O45.00070835.062529Koordinaten: 45° 0′ 2,5″ N, 35° 3′ 45,1″ O Standort: Staryj KrymKrim, Ukraine Zweck: armenisch-apostolisches Kloster Das Kloster Surb-Chatsch (armenisch Սուրբ Խաչ վանք ‚Kloster zum Heiligen Kreuz‘, ukrainisch Сурб-Хач) ist ein mittelalter…

Bagian dari seri tentang Pandangan Kristen Kristus Kristologi Nama dan Gelar Riwayat Hidup Injil Keselarasan Injil Petilasan Beribunda Perawan Kelahiran Pembaptisan Karya Pelayanan Khotbah di Bukit Mukjizat Perumpamaan Penistaan Penyaliban Penguburan Kebangkitan Kenaikan Ketaatan Bersemayam di Surga Perantaraan Kedatangan Ke-2 Relikui Isa (Pandangan Islam) Almasih Injil Maryam Hawariyun Wafat Almahdi Hari Kiamat Pusara Latar Belakang Latar Belakang Perjanjian Baru Bahasa Tutur Yesus Ras Yesus Si…

KemarauSampul album promo radio dari album KemarauAlbum studio karya The RolliesDirilis1979GenreFunk, popDurasi32:22LabelMusica Studio'sKronologi The Rollies Volume 3(1978)Volume 31978 Kemarau(1979) Kerinduan(1979)Kerinduan1979 Kemarau adalah album kesebelas dari grup musik The Rollies (album keempat di bawah nama New Rollies) yang dirilis pada tahun 1979 di bawah label Musica Studio's. Album Kemarau ditempatkan pada peringkat ke-66 dalam daftar 150 Album Indonesia Terbaik versi majalah Roll…

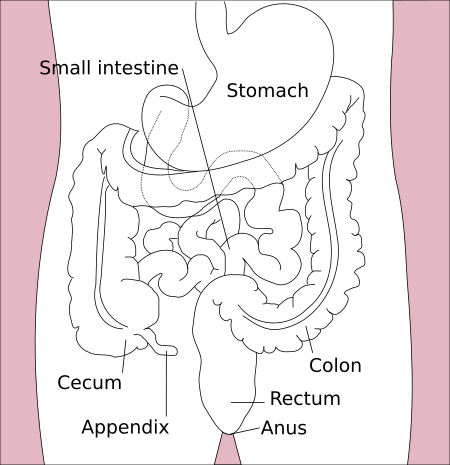

Organ system within humans and other animals Enteric redirects here. For other uses, see Enteric (disambiguation). Gastrointestinal tractDiagram of stomach, intestines and rectum in the average humanDetailsSystemDigestive systemIdentifiersLatintractus digestorius (mouth to anus),canalis alimentarius (esophagus to large intestine),canalis gastrointestinales stomach to large intestine)MeSHD041981Anatomical terminology[edit on Wikidata] Major parts of theGastrointestinal tract Upper gastrointes…

Qebehsenuf (IPA: Kˀɜ: bɜ̃ ʃe: nʉɸ) è una divinità egizia appartenente alla religione dell'antico Egitto, uno dei figli di Horo e quindi fratello di Imset, Damutef e Hapi. (qebešenuef) Qebeshenuefin geroglifici Indice 1 Mitologia 2 Altri nomi 3 Bibliografia 4 Altri progetti Mitologia Era un dio funerario. È raffigurato con la testa di falco e preposto alla protezione degli intestini con l'aiuto della dea Serket. Il suo punto cardinale è l'Ovest. Altri nomi Qebeshenuf Qebeshenuef Bibli…

Ini adalah nama Korea; marganya adalah Choi. Choi Jong Hoon 최종훈Informasi latar belakangNama lahirChoi Jong Hoon (최종훈)Lahir7 Maret 1990 (umur 34)Korea SelatanGenreRock, pop, R&BPekerjaanGitaris, vokalis, pemimpinInstrumenGitar, vokalisTahun aktif2007–2019LabelF&C Music (Korea)AI Entertainment Inc. (Jepang)Warner Music (Jepang)Artis terkaitF.T. Island, F.T. TripleSitus webOfficial website Choi Jong Hoon(최종훈; pronounced [tɕʰwe tɕo:ŋ hu:n ]) adalah mantan le…

Kanal Banjir pada Peta Tata Air Jakarta (2012). Kanal Banjir Jakarta adalah saluran air kolektor sebagai salah satu cara penanggulangan banjir Jakarta (dulu dikenal dengan nama Batavia) yang pertama kali dikonsepkan oleh Prof. Ir. Hendrik van Breen pada tahun 1913.[1] Inti konsep Kanal Banjir adalah mengendalikan aliran air dari hulu sungai yang berasal dari kawasan Dataran Tinggi Jonggol, Bogor dengan mengatur volume air yang masuk ke kota Jakarta dan akan membuat beban sungai di utara …

Kyiv КиївKievIbu kotaSearah jarum jam, dari kanan atas: Patung Berehniya di puncak Monumen Kemerdekaan, patung Bohdan Khmelnytsky, pemandangan Lapangan Kemerdekaan, Rumah Khimaira, Gedung Universitas Merah, dan Kyiv Pechersk Lavra. BenderaLambang kebesaranLogoNegara UkrainaMunisipalitasMunisipalitas Kota KyivDitemukanabad ke-5Raion List of 10 Darnytskyi RaionDesnianskyi RaionDniprovskyi RaionHolosiivskyi RaionObolonskyi RaionPecherskyi RaionPodilskyi RaionShevchenkivskyi RaionSolomiansk…

Anggun C SasmiAnggun saat tampil konser di Le Trianon, Paris, Prancis, pada bulan Juni 2012LahirAnggun Cipta Sasmi29 April 1974 (umur 49)Jakarta, IndonesiaPekerjaanPenyanyiPenulis laguArtis rekamanProduser rekamanAktrisTahun aktif1986–sekarangSuami/istri Michel Georgea (m. 1992–1999) Olivier Maury (m. 2004–2006) Cyril Montana (m. 2010–201…

Legislative election in the Soviet Union1954 Soviet Union legislative election ← 1950 14 March 1954 1958 → All 1,347 seats in the Supreme Soviet First party Second party Leader Nikita Khrushchev Party CPSU Independent Alliance BKB BKB Leader since 13 March 1953 Last election 1099 217 Seats won 1050 297 Seat change 49 80 Percentage 78.0% 22.0% Chairman of the Council of Ministers before election Georgy Malenkov CPSU Elected Chairman of the C…

Piala Super Italia 2021San Siro, MilanTurnamenPiala Super Italia Inter Milan Juventus Serie A Piala Italia 2 1 Perpanjangan waktuTanggal12 Januari 2022 (2022-01-12)StadionSan Siro, MilanPemain Terbaik Alexis Sánchez (Inter Milan)[1]WasitDaniele Doveri[2]Penonton29.696[catatan 1]← 2020 2022 → Piala Super Italia 2021 (dikenal sebagai Supercup Frecciarossa untuk keperluan sponsor)[3] adalah edisi ke-34 dari Piala Super Italia, piala super sepak bola…

Federally recognized Indian tribe of the United States Sandia PuebloSandia Pueblo flagLocation of Sandia PuebloTotal population500–600Regions with significant populations USA ( New Mexico)LanguagesTiwa, English, SpanishReligionRoman Catholicism, traditional Pueblo religionRelated ethnic groupsother Pueblo peoples, Kiowa people Sandia Pueblo (/sænˈdiːə/; Tiwa: Tuf Shur Tia) is a federally recognized tribe of Native American Pueblo people inhabiting a 101-square-kilometre (40 …

American psychologist This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these template messages) This article relies excessively on references to primary sources. Please improve this article by adding secondary or tertiary sources. Find sources: Hazel Rose Markus – news · newspapers · books · scholar · JSTOR (April 2023) (Learn how and when to remove this template message)This …

Artikel ini membutuhkan judul dalam bahasa Indonesia yang sepadan dengan judul aslinya. The MIRV U.S. Peacekeeper missile, with the reentry vehicles highlighted in red. Technicians secure a number of Mk21 reentry vehicles on a Peacekeeper MIRV bus. Multiple independently targetable reentry vehicle (MIRV) adalah payload atau muatan peluru kendali balistik yang berisi beberapa hulu ledak, dimana masing-masing memiliki kemampuan untuk untuk mengarah dan mengenai satu atau kelompok target. Sebalikny…

Stasiun Minami-Fukushima南福島駅Stasiun Minami-Fukushima pada Oktober 2015LokasiDannokoshi-25 Nagaikawa, Fukushima-shi, Fukushima-ken 960-1102JepangKoordinat37°43′25″N 140°27′22″E / 37.7235°N 140.4562°E / 37.7235; 140.4562Koordinat: 37°43′25″N 140°27′22″E / 37.7235°N 140.4562°E / 37.7235; 140.4562Operator JR EastJalur■ Jalur Utama TōhokuLetak269.4 km dari TokyoJumlah peron2 peron sampingJumlah jalur2Informasi lainStat…

County in Oklahoma, United States County in OklahomaPottawatomie CountyCountyPottawatomie County Courthouse in ShawneeLocation within the U.S. state of OklahomaOklahoma's location within the U.S.Coordinates: 35°12′N 96°56′W / 35.2°N 96.94°W / 35.2; -96.94Country United StatesState OklahomaFounded1891Named forPotawatomi peopleSeatShawneeLargest cityShawneeArea • Total793 sq mi (2,050 km2) • Land788 sq mi (2…

Artikel ini membahas mengenai bangunan, struktur, infrastruktur, atau kawasan terencana yang sedang dibangun atau akan segera selesai. Informasi di halaman ini bisa berubah setiap saat (tidak jarang perubahan yang besar) seiring dengan penyelesaiannya. Tiffany TowersTiffany Towers dalam pembangunan tanggal 8 Januari 2008Informasi umumLokasiDubai, Uni Emirat ArabPerkiraan rampung2007Data teknisJumlah lantai41Desain dan konstruksiArsitekWS Atkins & PartnersPengembangNakheel Tiffany Towers meru…